How Escrow Infrastructure Works for Stablecoin Payments

Escrow infrastructure that replaces manual trust with programmable rules for stablecoin payments.

Escrow Infrastructure Explained

Escrow infrastructure is a neutral system for holding and releasing funds based on predefined conditions rather than human discretion. In traditional settings, this often relies on manual processes, intermediaries, and opaque decision-making. In modern digital economies—especially those powered by stablecoins—these approaches struggle to keep up with the need for speed, transparency, and programmability.

Trustless Work implements escrow as programmable infrastructure. Funds are locked on-chain, roles and responsibilities are explicitly defined, milestones and conditions are verifiable, and releases occur only through cryptographic approvals. This allows platforms, marketplaces, and financial products to embed escrow directly into their payment flows while maintaining non-custodial control and full auditability.

Core Primitives of Escrow Infrastructure

Escrow

What it is: A neutral mechanism that holds funds securely until predefined conditions are satisfied.

Why it matters: It removes custody risk and prevents any single party from unilaterally controlling funds.

Roles

What it is: Explicit responsibilities assigned to each participant in an escrow.

Why it matters: Roles define who can approve, sign, or acknowledge progress, preventing ambiguity and conflicts of interest.

Milestones

What it is: Clear checkpoints that represent progress, delivery, or verification.

Why it matters: They tie approvals and payments to observable outcomes instead of assumptions.

Signatures

What it is: Explicit approvals executed by the party assigned to a specific role.

Why it matters: Funds only move when the correct role signs at the correct step, enforcing accountability.

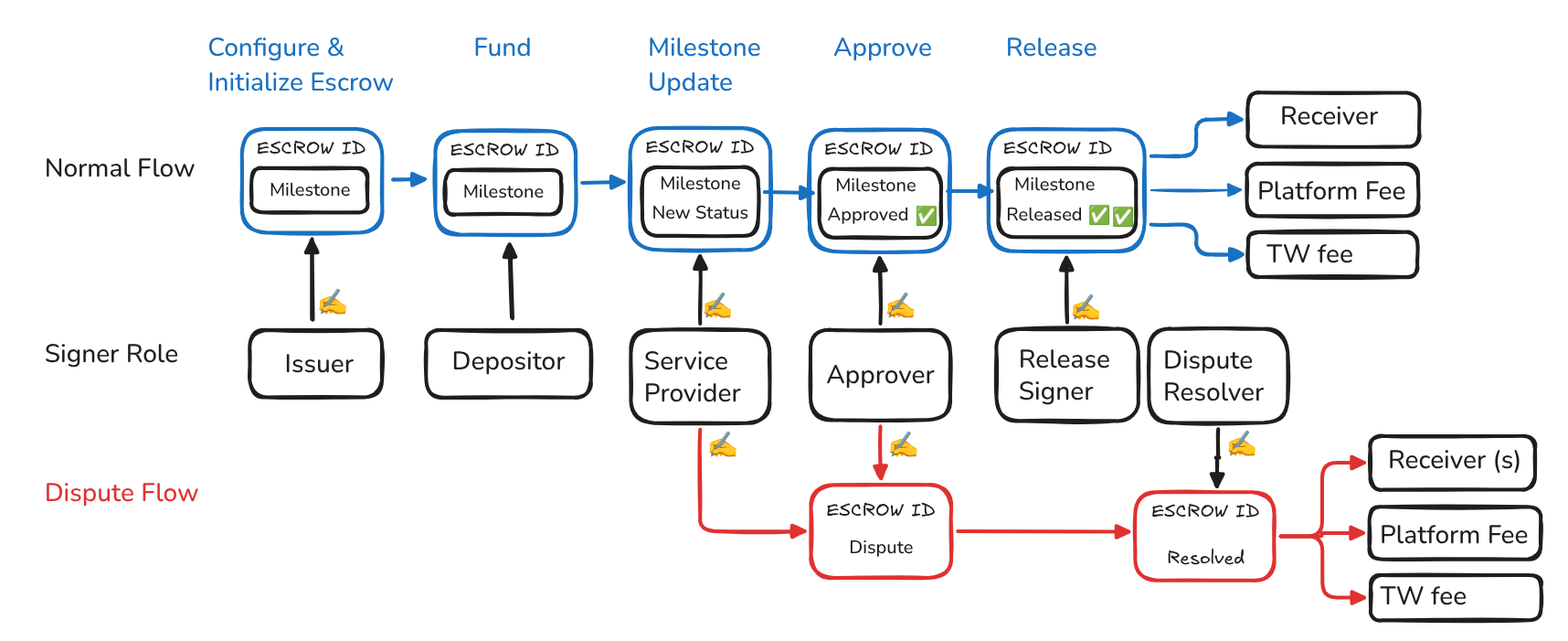

How Trustless Work Implements Escrow Infrastructure

Configure Roles, Milestones, and Fees

Define who funds the escrow, who receives funds, and who approves milestones. Configure milestones, approval logic, and platform fees directly as part of the escrow configuration. This allows platforms to initialize fully-defined escrows without writing or deploying smart contracts from scratch.

Initialize Escrows via API, SDK, or dApp

Create and fund escrows using the Trustless Work API, open-source SDKs, Escrow Blocks, or the backoffice dApp. Teams can clone audited templates and integrate escrow flows directly into their products to launch faster and reduce implementation risk.

Track, Approve, and Release Funds Transparently

Progress updates, milestone approvals, and fund releases are visible in real time through the escrow viewer. Every action is enforced through cryptographic signatures, ensuring that funds move only when the correct role approves the correct step.

Escrow Lifecycle

Auditability & Observability by Design

Trustless Work creates a complete, observable record of how funds move and who approved each step. Every escrow tells a clear story — without external logs, emails, or spreadsheets.

Structured Approval History

- Every approval is recorded

- Each signature is linked to a specific role

- No ambiguity about who approved what

Post-Hoc Auditability

- Escrows can be reviewed after completion

- Approvals and releases are already structured

- No reconciliation across systems required

Example: Payroll

Payroll processed through escrow can be audited after the fact by simply reading the escrow state. Every approval and release is already visible and verifiable.

How Escrow Is Used in Real Systems

Capital Inflows

When capital enters your platform, escrow ensures funds are reserved, transparent, and conditionally used.

- Crowdfunding and pre-funding

- Security deposits and collateral

- Investor capital and tokenization flows

- Prepaid and escrow-backed services

Capital Outflows

When capital leaves a treasury, escrow enforces milestone-based release and long-term auditability.

- Payroll and contractors

- Grants and bounties

- Milestone-based projects

- Treasury-controlled distributions

Platform in the Middle

When a platform coordinates payments between parties, escrow enables trust without custody.

- Marketplaces and freelance platforms

- P2P exchanges and OTC desks

- Trade finance and delivery-vs-payment

- Asset-backed commerce

Escrow Types

Single-Release Escrow

Funds are released once, after all agreed conditions are met.

Best suited for:

- Security deposits

- Asset transfers

- One-time service agreements

- Simple buyer–seller transactions

Why it matters:

- Reduces complexity for straightforward agreements

- Ensures full delivery before any funds move

- Minimizes coordination overhead

Multi-Release Escrow

Funds are released in stages as milestones or approvals are completed.

Best suited for:

- Milestone-based projects

- Grants and funding programs

- Long-running service engagements

- Progress-based payments

Why it matters:

- Reduces risk over time

- Aligns payments with progress

- Provides ongoing control and visibility

What You Can Build with Trustless Work

Conditional Payments

- Marketplace buyer–seller flows

- Gig and freelance payments

- Escrow-backed service agreements

Capital Allocation & Control

- Grants and milestone-based funding

- Crowdfunding with progress checks

- Treasury-controlled disbursements

Asset-Backed Workflows

- Security deposits

- Trade and delivery-based payments

- Escrow-backed guarantees

Enterprise Approvals

- Vendor payments

- Internal approval flows

- Compliance-driven fund releases

Who Uses Trustless Work

Platforms & Marketplaces

Enable trusted payments without building escrow infrastructure from scratch.

Stablecoin-Native Businesses

Coordinate payments and approvals with full visibility and control.

Enterprises

Introduce structured approvals and auditability into financial workflows.

Financial Innovators

Design new money flows that require accountability and transparency.

Builders & Product Teams

Integrate Trustless Work into platforms and workflows, enabling others to benefit from escrow without building trust infrastructure themselves.